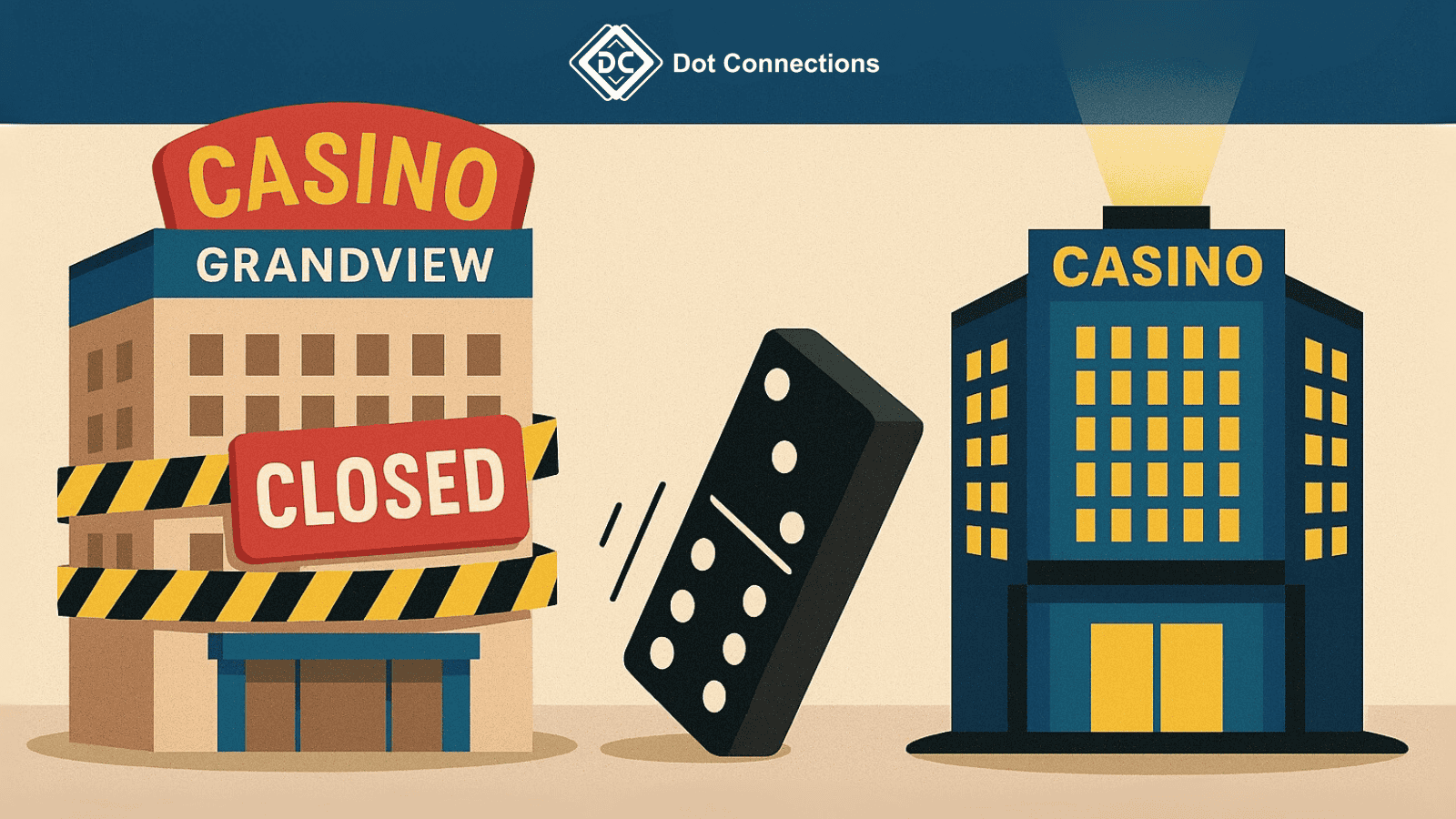

Macau Casino Market Sees Strong Growth Amid Satellite Casino Closures

The Macau casino market is defying expectations in 2025, showing strong Macau casino growth despite satellite casino closures. July 31 saw the closure of Grandview Casino, the first in a series of shutdowns ahead of the December 31, 2025 deadline, yet new financial data shows Macau’s gaming industry is stronger than ever.

Key Takeaways

- July 2025 GGR rose 19% year-on-year, reaching the highest monthly revenue since before COVID-19.

- Grandview Casino became the first satellite property to close as part of Macau’s structural gaming reforms.

- Analysts upgraded 2025 GGR growth forecasts — Morgan Stanley from 5% to 10%, Seaport from 7% to 9%.

- Growth driven by stronger Chinese renminbi, resilient tourism, and an improving Chinese economy.

- Local businesses in Taipa report over 50% drop in foot traffic since the closure, prompting support measures.

Macau’s Gaming Resilience Amid Change

Macau’s gaming industry is proving its resilience as the market experiences strong financial growth even while undergoing structural reform. Following the July 31 closure of Grandview Casino — the first in a wave of satellite casino shutdowns — new financial data reveals that Macau is on track for its best year since the pandemic.

GGR Hits Post-Pandemic High

According to the latest report, July 2025 saw a 19% year-on-year increase in gross gaming revenue (GGR), marking the highest monthly revenue since COVID-19 restrictions began. This follows an equally strong June, also up 19% year-over-year, making it the sixth consecutive month of annual growth.

Analysts Raise 2025 Forecasts

Morgan Stanley has revised its full-year GGR growth forecast from 5% to 10%, projecting total revenue at MOP 249 billion (US$30.8 billion). Seaport Research Partners also upgraded its forecast from 7% to 9% growth.

Key Drivers Behind Macau Casino Growth

- Fewer Chinese and Hong Kong tourists traveling to competing destinations like Thailand and Japan.

- A stronger Chinese renminbi supporting higher spending in Macau casinos.

- An improving Chinese economy, especially among the upper middle class — a key demographic for Macau gaming.

Local Economic Impact of Closures

While the revenue figures are encouraging, the structural shift away from the satellite casino model is impacting local economies. Merchants in Taipa and surrounding areas have reported over 50% drops in foot traffic since Grandview’s closure. In response, local authorities are planning promotional events and rental support schemes to revitalize the area.

A Dual Transformation

The developments highlight two simultaneous shifts in Macau’s gaming landscape:

- Structural reform — transitioning from third-party satellite casinos to concessionaire-owned properties.

- Financial recovery — sustained GGR growth signaling renewed investor confidence.

As the December 31, 2025 deadline for phasing out satellite casinos approaches, all eyes will be on how Macau balances operational consolidation with economic vibrancy.

At Dot Connections, we closely monitor global regulatory movements and market shifts to help iGaming operators and game providers make informed decisions. If you're exploring opportunities in regulated markets across Asia, Africa, or Europe, we’re here to guide you.

📩 Get in touch to learn how we can support your expansion strategy.

Follow Dot Connections for industry insights and strategic updates on global iGaming trends.

Industry update • Macau • Published: January 12, 2026

Macau 2025 GGR $30.9B — Q4 Event Costs Squeeze Margins

Macau closed 2025 with a powerful top-line recovery — roughly $30.9 billion in gross gaming revenue and a record 40.06 million visitor arrivals — and most operators rewarded frontline staff with one-month bonuses. Yet the fourth quarter exposed an important caveat: major event-related spending and portfolio adjustments compressed operating margins even as revenue climbed.

Table of Contents

Key takeaways

- Top-line rebound: Macau recorded roughly $30.9B in GGR and 40.06M visitor arrivals in 2025.

- Employee payouts: Most concessionaires issued one-month bonuses to frontline/non-management staff.

- Q4 margin pressure: Large event spending (NBA China Games, 15th National Games) plus costs from satellite-casino closures reduced operating leverage.

- Operator dynamics: Analysts flagged Galaxy and MGM China as likely Q4 share gainers; SJM faced integration costs (~4,000 absorbed staff); Sands grew revenue but saw margin pressure.

- What to watch: Focus on adjusted EBITDA, event ROI and labour-integration costs — not just GGR or visitor counts.

Quick summary

Macau enjoyed its strongest post-pandemic year in 2025: near-$31B GGR and a record number of visitors. Those headline gains enabled operators to award bonuses to many frontline staff and signalled broad demand recovery. However, fourth-quarter results showed that significant event-linked spending and portfolio restructuring can erode margin gains. Analysts caution that headline GGR and visitor figures tell only part of the story — adjusted EBITDA and event ROI will determine which operators truly benefit in 2026.The numbers at a glance

- GGR (2025): ≈ $30.9 billion (up ~9% vs. 2024; ~36% vs. 2023).

- Visitors (2025): 40.06 million (surpassing 2019’s 39.41M).

- Staff bonuses: Majority of concessionaires announced one-month discretionary bonuses for most non-executive employees.

- Q4 context: Analysts estimated industry EBITDA growth for Q4, but flagged material margin pressure tied to event and restructuring costs. Sands’ Q4 EBITDA was cited at roughly US$616M with an expected margin decline (~1.9 percentage points) attributable to event spend. SJM’s consolidation of satellite properties led to absorption of ~4,000 staff, raising short-term costs.

Why Q4 looked different: event and restructuring drivers

Large, headline events create visible benefits — tourism spikes, package sales, retail lift and brand exposure — but they also carry substantial incremental expenses.

NBA China Games: promotion costs and hospitality packages

Promoted by Sands China at The Venetian Arena, the NBA preseason brought sponsorship, production, venue and promotional costs. Sands acted as promoter and rolled out NBA-branded retail and hospitality packages.

15th National Games: venue support and funding commitments

Multiple concessionaires provided venues and funding commitments for the multi-city event, increasing short-term operating outlays.

Satellite casino closures: SJM consolidation and staff integration

SJM’s consolidation of satellite properties led to one-off closure costs and higher payroll/operating expenses as satellite staff were integrated into core properties.

These items explain why operating leverage in Q4 did not fully reflect revenue growth: event and restructuring spend reduced adjusted EBITDA margins even while GGR increased.

Market share and operator positioning going into 2026

Galaxy Entertainment: events & hold benefit

Benefitted from a heavy events and concerts schedule and favourable hold rates, translating into estimated market-share gains.

MGM China: favorable hold at MGM Cotai

Saw a lift from beneficial hold at MGM Cotai, boosting its Q4 performance.

Sands China: share gain vs. margin pressure

Gained share quarter-on-quarter but faced margin pressure from NBA and other event spend.

SJM Holdings: satellite integration impact

Saw share compression amid satellite closures and associated costs.

The NBA’s return to Macau in October 2026 (scheduled preseason games with the Dallas Mavericks and Houston Rockets) signals that events will remain central to operators’ strategies — and to their cost bases.

What stakeholders should watch

Investors: adjusted EBITDA, margins, CAPEX

Focus on adjusted EBITDA, margin trends and management commentary around whether event spend is one-off or part of a recurring strategy. Capex and labour integration costs matter as much as GGR.

Operators: event monetisation & labour integration

Prioritise monetisation of event traffic (premium packages, F&B, retail, hospitality add-ons) and rigorous cost control on event production. Efficient integration of staff and properties following consolidation is critical.

Employees & local economy: bonuses vs. restructuring risk

Bonuses are a positive sign for workers and household income, but restructuring and property closures can cause short-term disruption for affected staff.

Conclusion

Macau’s 2025 recovery is real: record visitors and near-$31B GGR demonstrate restored demand. Yet Q4’s event-driven cost load underscores an essential discipline: strong top-line numbers must be paired with disciplined event ROI and margin management. For 2026, operators that convert headline traffic into sustainable, margin-accretive revenue — while controlling event and integration costs — will be best positioned to outperform.

At Dot Connections, we track policy shifts and disruptive trends shaping the iGaming and online entertainment landscape worldwide. From compliance challenges to new market entries, our team delivers the intelligence operators and providers need to stay competitive.

🌍 If you’re planning to expand into dynamic markets in Asia, Africa, or Europe, our experts are ready to support your journey.

Follow Dot Connections LinkedIn for regulatory updates, market analysis, and strategic guidance on the future of iGaming. Or Contact us here.

Industry update • Macau • Published: January 5, 2026

Macau's casinos rebounded $30.9B in 2025. A real comeback or a temporary bubble?

The Macau 2025 GGR rebound — a return to roughly MOP247–248 billion (US$30.8–30.9B) — marked the strongest post-pandemic performance and sets the stage for corporate and policy shifts that will shape 2026.

Table of Contents

Quick summary

Coming off a surprisingly strong year, the Macau 2025 GGR rebound delivered nearly US$30.9 billion in gaming revenue and signalled a structural recovery as the market pivots from VIP/junket dependence toward premium-mass and integrated-resort demand.

Macau closed 2025 with a surprisingly strong recovery—casino GGR reached post-pandemic highs and several months matched or exceeded pre-COVID peaks. At the same time, structural changes from Beijing and the Macau government (licensing conditions, forced non-gaming investment, junket restrictions) are reshaping the market. Analysts see upside for both GGR and Macau-centric equities if China’s macro policy and visitation trends keep improving, but near-term risks (macro, policy, and fiscal sensitivity) remain.

2025 in review — a comeback that surprised many

Macau finished 2025 with gross gaming revenue (GGR) roughly in the MOP247–248 billion range (about US$30.8–30.9 billion), the highest annual total since 2019 and about ~9% year-over-year growth for the market. Several late-2025 months — including a >$3B month in October and a strong December — helped push the recovery close to pre-pandemic scale. Those results show the SAR’s ability to pivot from a VIP-dominated model toward a more resilient premium-mass and mass market mix. But the recovery hasn’t been just about gaming: the 2022 relicensing process required Macau’s six concessionaires to commit very large non-gaming investments and longer concession horizons, forcing operators to accelerate hotel, retail, MICE (meetings/incentives/conventions/exhibitions) and other leisure projects alongside their casino floors. That structural push toward integrated-resort, family and convention demand is now an explicit part of Macau’s post-pandemic playbook.What’s changed structurally — licenses, fees, and corporate deals

Two interlocking forces are reshaping operator economics:- Concession-era investment commitments and government monitoring. As part of the 2022–2023 relicensing, Macau tied the new 10-year concessions to extensive non-gaming investments and diversification targets. The government has been actively reviewing and pressing concessionaires on those commitments to reduce Macau’s dependence on pure gaming tax receipts. That has shifted capital allocation and long-term strategy across the Big Six.

- Operator contract re-engineering and brand/licensing changes. A concrete recent example: MGM China renegotiated long-term brand/licensing economics with parent MGM Resorts — doubling the monthly brand fee from 1.75% to 3.5% of adjusted consolidated net monthly revenues under the new terms (with caps and allocation rules). That deal locks the MGM brand in place through the current concession cycle but raises near-term profit-share costs for MGM China and shows that intracompany commercial terms (and their accounting/EBITDA impact) are now material to investors and analysts.

The macro backdrop and consensus views for 2026

A few macro and market threads underpin the near-term outlook:

- China’s policy tilt toward proactive fiscal/consumption support. Beijing has signaled more proactive macro policy for 2026 to shore up consumption and investment — a dynamic that historically flows through to outbound travel and discretionary spending, both important for Macau demand. If these policies meaningfully lift Chinese domestic consumption and travel, Macau could benefit materially.

- Analyst house views — cautious optimism. Some sell-side analysts expect modest but positive GGR growth in 2026 (consensus in the mid-single digits), while a handful (e.g., Stifel coverage cited in market notes) argue consensus may be conservative and project upside scenarios of ~4–8% GGR growth if visitation and premium-mass spending remain strong. At the same time, investor sentiment toward Macau equities remains mixed: the group trades at discounts to long-run historical multiples, which some see as a buying opportunity if macro risks fade.

The policy tailwinds and more normalized travel could lift 2026 GGR beyond conservative forecasts, but that outcome is conditional on China’s domestic recovery sustaining and on Macau’s ability to convert infrastructure investments into repeat visitation.

Risks and near-term frictions to watch

- Policy and fiscal sensitivity. Macau’s fiscal balance is highly correlated with gaming revenues; local officials have warned of budget strain if revenues fall sharply. That makes the SAR vulnerable to downside macro shocks.

- Operator margin pressure from contractual fees and capex. Brand fees (like MGM’s new terms) or large non-gaming capex programs can compress near-term EBITDA margins even while building long-term value. Analysts have already cut near-term EBITDA forecasts for some operators after the MGM brand fee change.

- VIP cohort uncertainty. The junket-led VIP channel has been structurally altered by regulatory action; while premium and mass players have filled some gaps, a sustained return of high-value VIPs would materially boost upside — and the timing/scale of any VIP recovery is uncertain.

What to watch in 2026 — 6 concrete datapoints and catalysts

- Monthly GGR momentum (particularly seasonal high months such as Lunar New Year and October): continued above-trend growth would validate upside scenarios.

- Mainland China policy announcements with clear consumption/travel stimulus (e.g., travel subsidies, visa/travel facilitation, or stimulus checks).

- Operator quarterly guidance and capex updates (how quickly nongaming projects open and ramp).

- Concession compliance reports / government reviews of pledged investments — these will determine whether Macau keeps pushing hard on diversification or tolerates slower rollouts.

- VIP segmentation data(table counts, high-roller volumes) — any sign of a VIP re-emergence would be a market catalyst.

- Earnings and licensing/legal headlines around intracompany deals (brand fees, revenue-sharing) that affect operator margin profiles (the MGM example is already instructive).

Investment and strategic implications (quick takeaways)

For investors:

Macau equities may be underpriced relative to a recovering GGR baseline, but company-specific lease/licensing terms and capex commitments are now first-order risk drivers. Value seekers should weigh macro upside against near-term margin headwinds (brand fees, heavy non-gaming investment).

For operators and policymakers:

The strategic priority is converting capital into compelling non-gaming offerings that broaden Macau’s appeal (families, MICE, leisure) while preserving casino profitability. Close coordination with Beijing’s travel and consumption levers would magnify positive outcomes.

Final appraisal — an evolving opportunity with conditional upside

Macau finished 2025 with a strong recovery headline number and a clearer roadmap to an integrated-resort future. That creates a plausible bull case for 2026: China’s macro support, improving travel, and continued premium-mass strength could lift GGR and create meaningful upside for operators and their equities. But the transition is being managed under new economic, fiscal and contractual constraints — meaning the upside is real, yet conditional. Watch GGR monthly prints, China macro measures, concession compliance, and operator margin moves closely; those datapoints will determine whether 2026 becomes the year Macau returns to its full pre-pandemic momentum or merely consolidates the gains of 2025.

Industry update • Vietnam • Published: December 29, 2025

Sun Group Breaks Ground on US$2B Resort in Vietnam — What Online Game Operators Should Watch

A US$2 billion integrated “resort city” including a casino component has started construction in Vietnam. Following the project's groundbreaking on 19 December 2025, the development’s regulatory and commercial effects create immediate digital opportunities — and obligations — for online-only game operators across Southeast Asia.

Table of Contents

Quick summary

Sun Group has commenced construction on a major integrated resort in Vietnam with a casino component targeted to open in 2028 and full project completion expected across multiple phases by 2034. The development aims to boost inbound and domestic tourism and is being pursued under Vietnam’s pilot framework that may allow Vietnamese nationals to play at selected casinos. For online game operators, the primary implications are regulatory change, travel-driven acquisition windows and a need to harden payments, KYC and fraud controls.

Why online-only operators should care

Even if your business is 100% web-based, a large onshore gaming project in Vietnam changes market dynamics that affect acquisition, retention, compliance and revenue. Key impacts to monitor and act on include:

- Larger addressable market (potential) — extensions or clarifications of Vietnam’s pilot rules could increase domestic player eligibility and lifetime value for Vietnam-focused cohorts.

- Travel windows become digital acquisition windows — new flight routes and tourism marketing tied to the resort create predictable peaks you can exploit with geo- and time-targeted paid acquisition and reactivation campaigns.

- Content & promo hooks — resort milestones (groundbreaking, soft opening, grand opening) create marketing moments: Van Don / Vietnam-themed tournaments, limited-time drops and milestone leaderboards drive activation and reactivation.

- Payments, KYC & compliance readiness — increased local-play activity typically brings more scrutiny on payment rails, identity verification and transaction monitoring. Integrating compliant eKYC and local payment methods early reduces onboarding friction.

- Cross-vertical affiliate opportunities — travel and tourism campaigns open new affiliate pathways (travel bloggers, regional publishers and SEA ad partners) for cost-effective user acquisition.

Recommended online-only operator actions (90-day & 12-month playbook)

Immediate (0–90 days)

- Regulatory monitoring: assign legal/compliance to track draft decrees and policy changes affecting local-player access (deposit rules, entry fees, financial-capacity requirements).

- Payments & eKYC audit: audit current payment rails and eKYC flows; add local payment options where feasible and test onboarding for low friction while retaining AML controls.

- Ad creative bank: prepare geo-localized creatives for NE-Asia and target domestic cities with travel origins (short headlines and milestone hooks).

Next (3–12 months)

- Geo/time-target acquisition campaigns: plan campaigns that align with travel peak windows (route launches, holidays). Use short bursts with elevated CPA bids in origin markets.

- Event calendar: schedule Van Don-themed tournaments, limited drops and leaderboards to coincide with publicized resort milestones to maximize PR-driven interest.

- Affiliate partnerships: brief travel/tourism affiliates and regional publishers on campaign mechanics and tracking. Offer short-term elevated CPA for travel-window traffic.

- Product prototypes for local players: design prepaid, capped-play and low-ticket bundles that can be toggled in region-specific deployments to comply with potential restrictions.

- Risk & fraud tuning: prepare dynamic risk thresholds for deposit velocity, cross-border payment flows and suspicious account behaviour ahead of acquisition spikes.

Three digital campaign ideas (ready to run)

- Milestone Tournaments: 7–14 day Van Don-themed tournaments (low buy-ins, leaderboard prizes and digital goods) timed to construction/opening milestones. Promote across paid social, email and affiliates.

- Geo-Flight Pushes: run targeted acquisition windows in feeder origin cities whenever new routes or charters are announced, with tailored creative and limited-time registration bonuses.

- Travel Affiliate Bundle: partner with travel content creators to embed promo codes and track registrations; measure incremental revenue via UTM and adjust CPA offers.

Technical & compliance checklist

- Payment integrations: add locally preferred payment methods and ensure seamless reconciliation across currencies and rails.

- eKYC: implement fast identity verification with fallback manual review workflows to maintain conversion while meeting AML/KYC requirements.

- Transaction monitoring: instrument real-time alerts for velocity, chargeback patterns and unusual cross-border flows.

- Data localisation & privacy: confirm how local-player data will need to be stored and processed under Vietnamese rules or partner jurisdiction requirements.

- Legal readiness: prepare templated T&Cs and localized user disclosures for Vietnam-specific offerings and deposit caps.

Risks & caveats

- Regulatory uncertainty: draft decrees and final policy decisions could change the economics and eligibility for local players (age limits, financial proof, entry fees or caps).

- Market timing: integrated resorts are long-lead assets — meaningful onshore spillover to online channels may materialize only once openings and transport links are fully active.

- Reputational & compliance exposure: increased local activity means greater public scrutiny. Operators must balance growth with robust compliance and responsible gaming safeguards.

- Environmental & community sentiment: large coastal developments often attract environmental and local community attention; this can affect PR windows and market sentiment.

KPIs to track

- Geo-specific CAC & ROI: monitor cost-per-acquisition by origin market and by travel-window cohort.

- New-registration LTV: compare cohort LTV for users from targeted travel-origin geos vs baseline markets.

- Onboarding conversion rate: track eKYC pass rates and time-to-first-deposit for local-player cohorts.

- Affiliate performance: measure incremental revenue and retention from travel/tourism affiliate traffic vs baseline affiliates.

- Risk metrics: chargeback rate, suspicious-account rate and deposit velocity during campaign spikes.

Conclusion

Sun Group’s US$2 billion development in Vietnam is primarily a physical resort project, but its commercial and regulatory ripple effects create an early-mover window for online-only game operators. Potential local-player access, travel-driven acquisition spikes and new affiliate pathways mean operators who prepare now — focusing on regulatory monitoring, payments/eKYC readiness and geo-targeted acquisition — will be best positioned to capture high-value cohorts as they emerge.

India iGaming at a Crossroads: Supreme Court Consolidation Defines the Path for 2026

Published: December 15, 2025

The Indian iGaming sector is bracing for a definitive ruling as the Supreme Court takes centralized control of all legal challenges against the highly restrictive PROGA Act, 2025. This move, combined with the crippling 40% GST, forces operators to urgently reassess their content strategies. Dot Connections provides the essential content resilience and compliance tools needed to navigate this volatile market where agility is mandatory for survival.

Key Takeaways for Operators

- The Supreme Court has become the single point of judgment, consolidating all high court petitions against the PROGA Act.

- The market faces a dual threat: near-total prohibition on 'Chance-Based Games' and an economically unsustainable 40% GST on GGR.

- The core challenge is differentiating between legally permissible 'Skill-Based Games' and high-risk 'Chance-Based Games'.

- Actionable Solution: Operators must leverage smart content aggregators (like Dot Connections) to enable rapid filtering and a strategic pivot to compliant content streams.

The Regulatory Storm: Prohibition Meets Punitive Taxation

The India iGaming Regulation sector has entered a period of unprecedented regulatory paralysis as the calendar turns towards 2026. The Supreme Court of India has seized control of the entire legal battle surrounding the contentious Promotion and Regulation of Online Gaming Act, 2025 (PROGA), postponing the critical hearing until the new year.

This pivotal move, which consolidates all existing high court challenges (from Madhya Pradesh, Karnataka, and Delhi), establishes the Supreme Court as the **sole arbiter** of the industry’s future, setting the stage for a truly definitive and historic ruling.

The Dual Legislative Threat

The market instability is fueled by a dual challenge that has fundamentally altered operational viability:

- The PROGA Ban: Passed in August 2025, the PROGA Act aims for a near-total prohibition of **all forms of real-money online gaming**, including crucial segments like poker, rummy, fantasy sports, and traditional casino offerings. The industry argues this ban is overly broad and stifles a nascent, multi-billion dollar economy.

- The 40% GST Tax: Compounding the legal threat is the effective tax rate of **40% GST** on the face value of bets (Gross Gaming Revenue), a levy that has proven economically unsustainable for many operators.

Industry associations warn that this combined pressure will not eliminate gambling, but rather **force millions of users onto unregulated, illegal betting platforms**, thereby increasing social harm and forfeiting billions in potential tax revenue.

Strategic Response to India Regulation 2026: Content Resilience in a Volatile Market

For operators navigating this treacherous environment, the traditional strategy of "wait and see" is insufficient. As a leading Casino Game Aggregator, **Dot Connections** offers immediate, actionable solutions focused on content resilience and jurisdictional compliance.

Our core strength lies in helping operators differentiate between content that may be legally viable ('Skill-Based Games') and content facing outright prohibition ('Chance-Based Games').

Mitigating Risk: Three Pillars of Content Security

Our approach mitigates risk for our partners by ensuring rapid content deployment and withdrawal based on evolving legal precedents:

- Intelligent Content Filtering and De-risking: We enable operators to quickly audit and filter their content portfolio, prioritizing demonstrable "skill-based" games and content that are less likely to face legal challenge. Our system allows for the seamless delisting of high-risk, chance-based titles (traditional slots, roulette) from the Indian jurisdiction instantly.

- Data-Driven Reallocation: Our aggregation platform provides real-time performance analytics. Partners can identify precisely which content segments are rendered unprofitable by the 40% GST and use this data to execute a quick, data-backed strategic pivot toward safer, regulated jurisdictions across Asia and LATAM.

- Guaranteed Compliance Gateway: By aggregating only certified content and maintaining robust AML/KYC standards, Dot Connections acts as a compliance shield, ensuring that any content remaining active adheres to the strictest technical and legal specifications mandated by the Indian government (should a regulated framework eventually emerge).

Conclusion: Agility is Mandatory

The Supreme Court’s decision to consolidate the legal challenge signifies that the Indian iGaming market is at a critical juncture. For operators, success in 2026 will hinge on **flexibility, rapid decision-making, and leveraging a content aggregator that provides true operational agility.** Partnering with Dot Connections ensures your content strategy is resilient, compliant, and ready for any outcome.

At Dot Connections, we track policy shifts and disruptive trends shaping the iGaming and online entertainment landscape worldwide. From compliance challenges to new market entries, our team delivers the intelligence operators and providers need to stay competitive.

🌍 If you’re planning to expand into dynamic markets in Asia, Africa, or Europe, our experts are ready to support your journey.

Follow Dot Connections for regulatory updates, market analysis, and strategic guidance on the future of iGaming.

Macau 2025: Strong November GGR. Regulatory Shake-Up Redefining the Market

December 8th, 2025

In November 2025 Macau reported MOP 21.09 billion (~US$2.63 billion) in gross gaming revenue (GGR), a 14.4% year-on-year increase that extended a ten-month streak of YoY gains. The unexpectedly strong top-line result lifted Macau-exposed casino stocks, but it comes amid a swift regulatory restructuring that is accelerating the closure of small satellite casinos. Contributing to Macau Nov 2025 GGR, these developments mark a market that is both bullish on near-term demand and structurally in transition.

Key takeaways

- November GGR: MOP 21.09B (~US$2.63B), +14.4% YoY.

- 11-month total (2025): approximately MOP 226.5B (~US$28.26B) — close to the government’s year forecast.

- Recovery drivers: robust mass-market play and growing nongaming activity (entertainment, events, FnB).

- Macau shows strong near-term demand (GGR) and investor optimism, while regulatory-driven consolidation is forcing the industry to shift toward integrated resorts and nongaming experiences.

- The medium-term winners will be operators that convert cash flow into high-quality nongaming assets and manage workforce and capacity transitions smoothly.

- Monitor China’s consumer policy and GGR segmentation for signs of sustainability.

November numbers and 2025 context

November’s GGR was notable because it arrived in a month that normally follows the Golden Week spike in October. The result — roughly 92% of November 2019 GGR — is the strongest recovery level Macau has seen since the pandemic. After 11 months, cumulative 2025 GGR stands only marginally below the SAR government’s full-year projection, signaling a broad-based recovery that appears to be powered not just by VIPs but increasingly by mass and premium-mass segments.

Market reaction: equities and sentiment

The better-than-expected GGR triggered immediate gains in shares of operators with heavy Macau exposure (Sands, Wynn, MGM, Melco, Galaxy, etc.). Analysts note that government forecasts for 2026 tend to be conservative; if GGR continues to outpace official estimates, there remains upside for Macau-centric equities. That said, markets remain sensitive to macro and policy signals — momentum can be strong, but it is not immune to abrupt shifts.

Regulatory shift: satellite closures and industry reconfiguration

Simultaneously, Macau is undergoing a regulatory and structural realignment. After a multi-year transition following the 20-year licensing cycle renewal, the government is tightening sublicensing rules. The result has been a wave of closures among smaller satellite casinos (budget/no-frills venues operating under sublicenses). Examples in December include several satellite shutdowns and the announced closure of Casino Fortuna on 9 December 2025. Roughly ten of eleven sublicensed satellite venues are slated to exit this year; some properties have been acquired by main concessionaires.

The regulatory intent is explicit: reduce reliance on small, gaming-centric venues and promote integrated resorts that prioritize nongaming assets — concerts, retail, hotels and family-oriented tourism. Authorities are coordinating with operators and labor agencies to manage staff reallocation and worker protections during the transition.

How the supply and demand trends interact

These developments should be read together, not in isolation.

Positive interaction

- Consolidation could concentrate spending at integrated resorts that generate higher ancillary (nongaming) revenue per visitor.

- Strong mass-market demand provides a healthier revenue base that is less volatile than VIP dependence.

- If operators redeploy cash flow into nongaming investments, Macau’s tourism offer could become more resilient and attractive to repeat visitors.

Friction and short-term risk

- Closing satellites reduces immediate capacity outside the big resorts, potentially displacing some gaming demand until larger resorts absorb it.

- Workforce reallocation and operational consolidation create execution risk and near-term cost variability.

- Long-run success hinges on China’s macro environment and domestic consumption policies — stimulus, travel normalization, and discretionary spending remain critical.

Implications by stakeholder group

- Investors: Monitor GGR segmentation (mass vs VIP), concessionaires’ capital allocation into nongaming assets, and near-term margin impacts from consolidation. Conservative government forecasts may hide upside, but regulatory execution is a key risk.

- Operators: Prioritize high-quality nongaming experiences, seamless guest migration from satellite closures, and clear workforce transition plans. Scale benefits exist but require disciplined execution.

- Policymakers & tourism planners: The shift is deliberate — from a gambling-centric model to a diversified tourism hub. Success will depend on enabling continued event programming, connectivity, and visitor services that make Macau attractive beyond gaming.

Conclusion

Macau’s November 2025 GGR underscores a robust recovery and renewed investor optimism. At the same time, an accelerated regulatory push to remove satellite casinos is reshaping how the market is structured. If concessionaires convert stronger GGR into compelling nongaming investments and China’s consumption backdrop remains supportive, Macau could evolve into a more diversified, resilient tourism destination. The transition, however, carries short-term disruption and execution risks that market participants should monitor closely.