APEC, Oct 31–Nov 2, 2025 • Updated: Nov 3, 2025

Thailand no-casino policy 2025 has been reaffirmed by Prime Minister Anutin Charnvirakul, pausing Integrated Resort (IR) legalisation and shelving earlier entertainment-complex proposals.

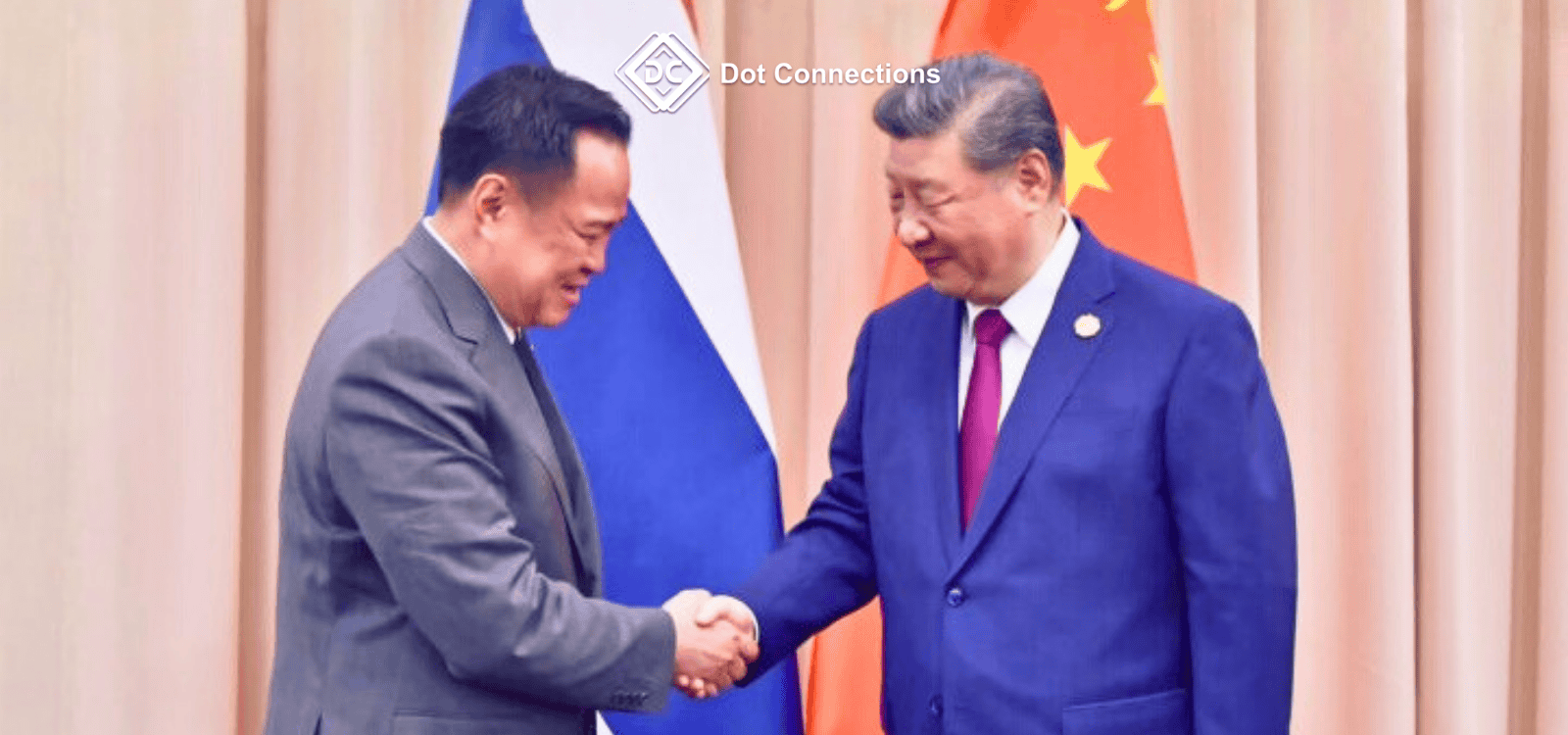

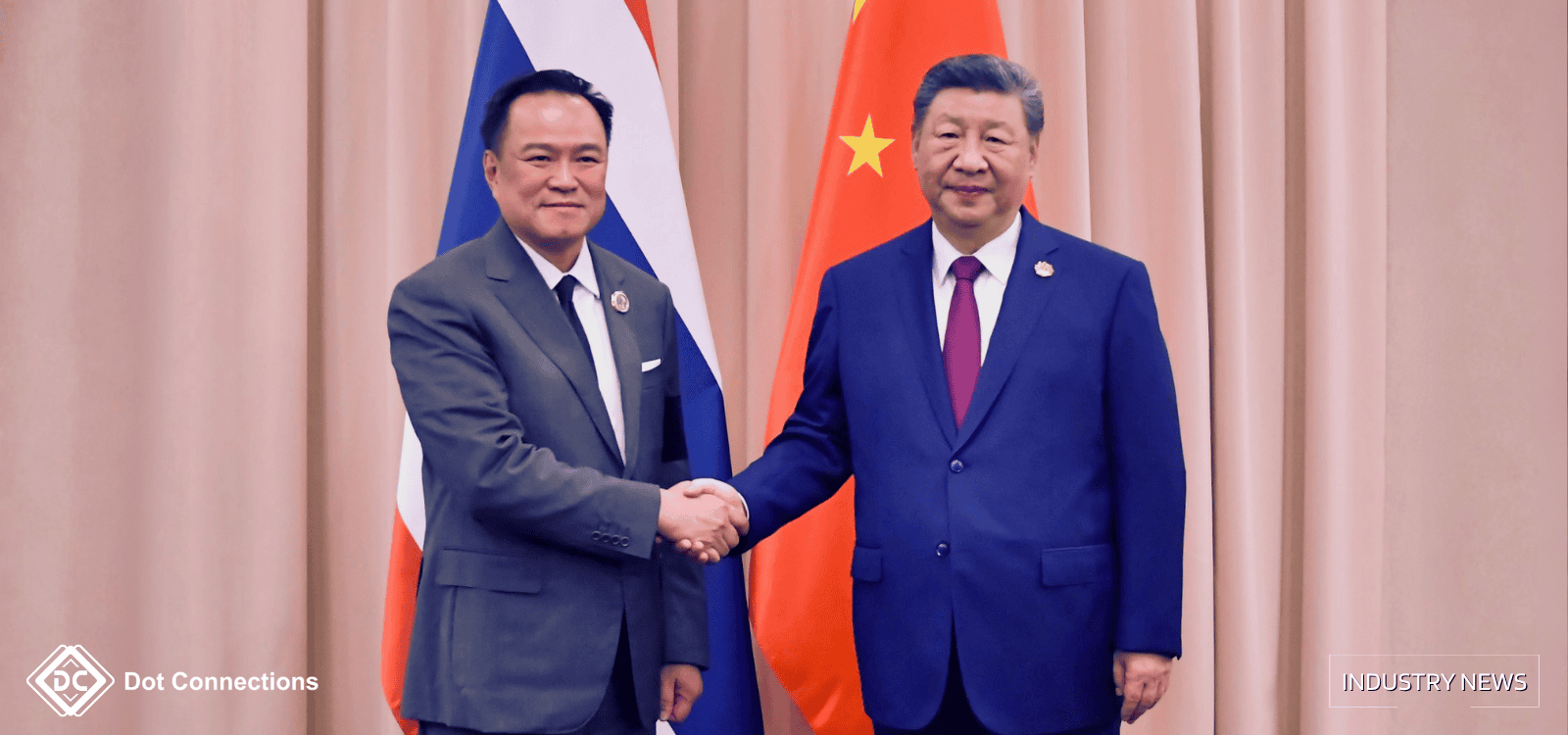

Thailand has reconfirmed a no-casino policy for the current term, effectively pausing Integrated Resort (IR) legalisation and shelving previous “entertainment complex” proposals. During APEC, PM Anutin told President Xi that Thailand would pursue growth via people, products, and technology rather than gambling revenue.

Government spokespeople noted that most Thais oppose legalised gambling. In the APEC bilateral, China praised Thailand’s stance, reiterated its principle of non-interference, and indicated it may apply domestic measures to limit outbound travel focused solely on casino gambling. This amounts to a clear diplomatic signal aimed at reducing friction over casino-tourism and building goodwill for broader tourism and investment cooperation.

An IR is a large multi-use complex combining hotels, MICE facilities, retail, dining, entertainment and—where permitted—casino gaming.

Not necessarily. Non-gaming entertainment complexes remain possible, but casino legalisation is not on the agenda this term.

Any change depends on future administrations and legislative priorities. For planning, treat Thailand as a non-gaming market in the near to medium term.

Need a compliance brief or localization of disclosures for Thailand? Contact Dot Connections to align product, UX, and policy updates across APAC.

As a leading Game Aggregator with strong Business Intelligence in iGaming, Dot Connections provides operators and partners with market insights, data-driven strategies, and premium gaming content. We keep you ahead of the curve in Asia’s fast-evolving gambling landscape.

Follow Dot Connections for regulatory updates, market analysis, and strategic guidance on the future of iGaming.